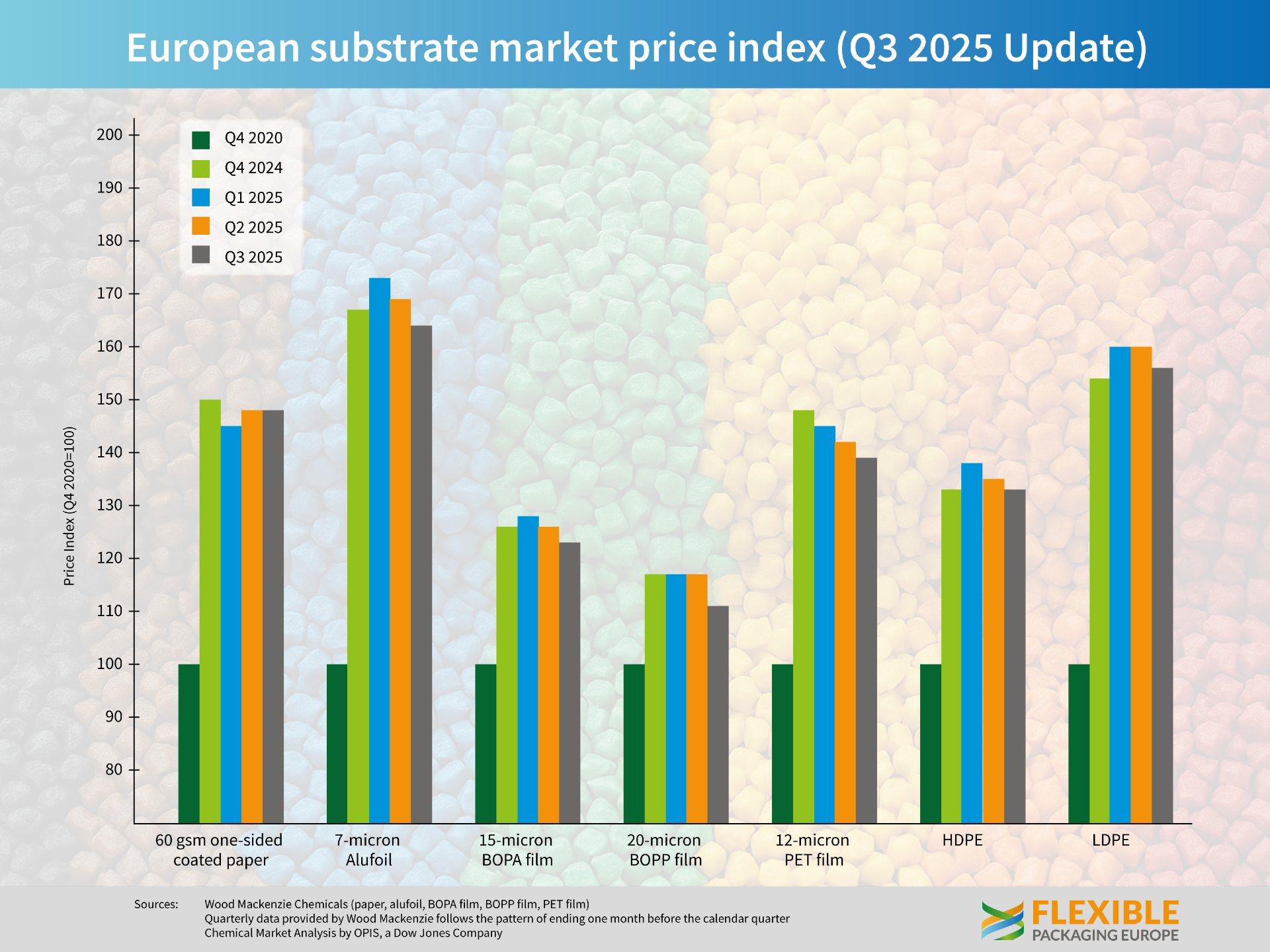

The markets for flexible packaging materials experienced minor price decreases across substrates in the third quarter of 2025. Aluminium foil (7 micron) showed particularly pronounced reductions, alongside BOPA, BOPP and BOPET films. While one-side coated paper (60 g/m²) remained stable, HDPE and LDPE continued the weaker trends seen during the first half of the year.

Alexander Tkachenko, Wood Mackenzie, commented: “BOPET Film prices have come down slowly in Q3 by 5 c/kg. Price reductions have mostly come from offshore, while there were mostly rollovers from European producers. BOPP Film prices have come down by 8 c/kg due to lower resin costs also coming down and BOPA Film prices have fallen by 10 c/kg this quarter. Lower prices are partly due to the falling cost of PA6 resin. Alufoil prices have come down by 17 c/kg, most of this price decrease is attributable to conversion costs coming down by around 10c/kg. In addition, the LME ingot price is down by 5 c/kg. Paper prices remain unchanged. Short fibre pulp prices have decreased by EUR 166/t mostly due to higher inventories.”

Markets less unstable

The polyethylene markets were also under pressure. Kaushik Mitra, Chemical Market Analytics by OPIS, a Dow Jones Company, noted: “Markets were less unstable this quarter, but sentiments were weaker. July/August are traditionally the weakest months of the year due to the summer lull, and this year the drop in demand was more than usual. The recovery that usually happens in September is not yet visible as end markets are struggling with macroeconomic slowdown and higher imports from China that have dampened local demand. The biggest development in this quarter is on the trade front, with the EU and US finally signing the trade deal. But a provision in the deal is raising particular interest: the ostensible EU proposal to give a duty waiver to US PE exports into the region. Although the final list with HS code for free trade items is yet to be published, the broad scope of the proposal keeps such possibilities wide open. If the tariff is waived, US PE resins would flood the European market and further weaken the European production base, which is already reeling under sliding competitiveness. A significant surge in US exports into Europe is already sensitising the market about anti-dumping scenarios being created, but buyers are welcoming the duty waiver as they feel it will make PE resins more affordable.”

Challenging market situation

Overall, the situation in the flexible packaging markets remains challenging. Energy prices for electricity and gas are still high and volatile, Europe’s industry is becoming increasingly import-dependent, and demand growth is slowing as many consumer goods categories underperform.

Guido Aufdemkamp, Executive Director of Flexible Packaging Europe (FPE), concluded: “The raw material markets in the third quarter were characterised by across-the-board price declines. While this provides some short-term relief for converters, overall demand in key consumer sectors remains weak. Added to this are uncertainties linked to geopolitical and trade developments, particularly the debate around possible tariff waivers for US polyethylene. For the second half of 2025, we therefore expect market conditions to remain challenging while the industry is hoping for some stable upwards trends in private consumption, hence supporting the demand for flexible packaging.”