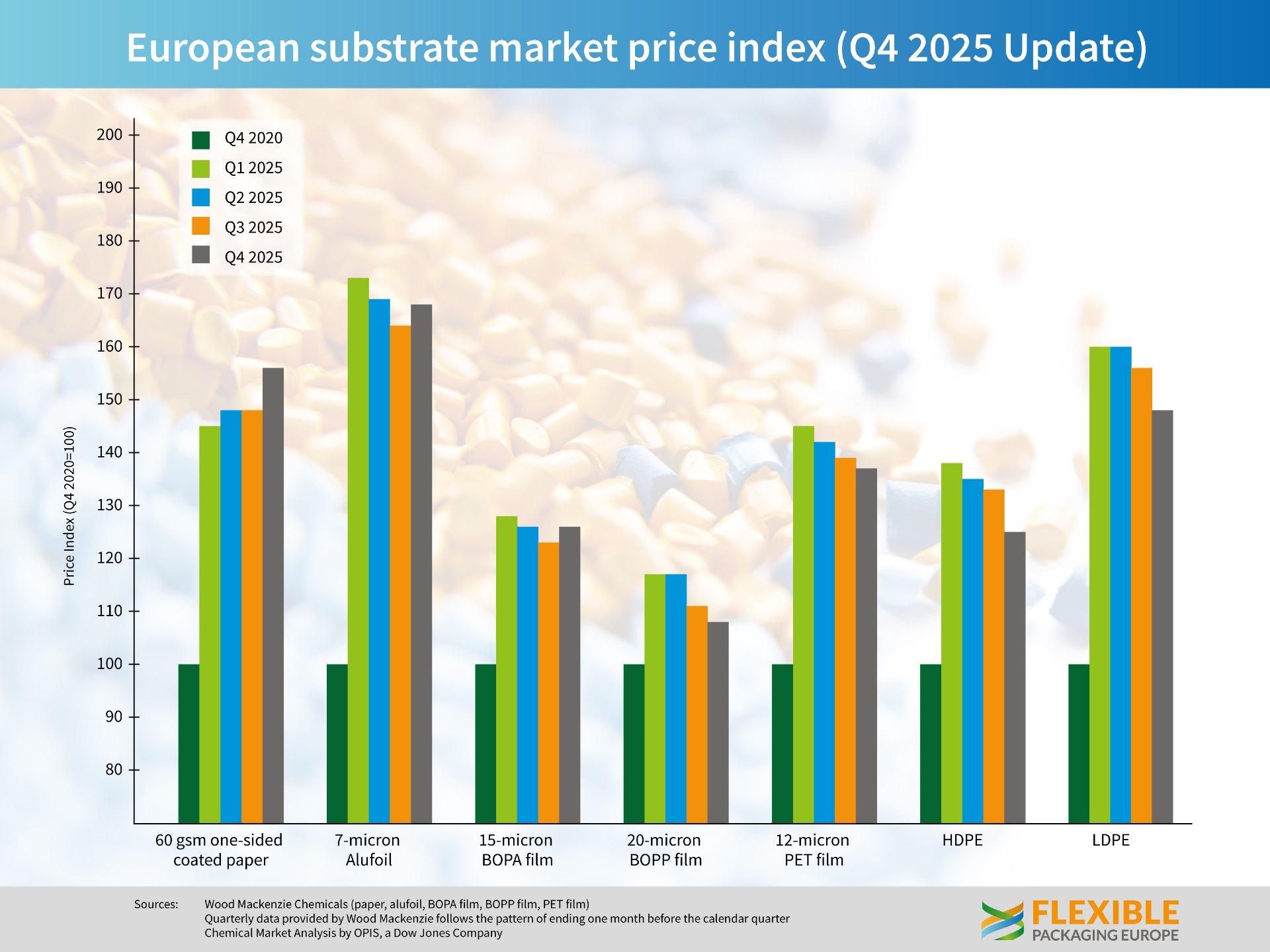

The markets for flexible packaging materials recorded further price adjustments in the fourth quarter of 2025. Based on the FPE raw-material index (Q4 2020 = 100), quarterly minimum prices decreased quarter-on-quarter for most substrates: One-sided coated paper (60 g/m²) fell by 3%, BOPA (15 micron) by 2%, while BOPP (20 micron) and BOPET/PET film (12 micron) both dropped by around 5,8%. The polyethylene markets remained under pressure as well, with mid-price levels for HDPE down by 6% and LDPE down by 5% compared with Q3 2025. Aluminium foil (7 micron) was the main exception, edging up by 1% quarter-on-quarter. Year-on-year, price levels were generally lower than Q4 2024 while aluminium foil was only marginally lower.

Producers try to gain volumes in a weak market

Alexander Tkachenko, Wood Mackenzie, commented: “BOPET Film prices paid have come down by an average of 14c/kg. Producers try to gain volumes in a weak market as well as pressures from offshore. BOPP Film prices paid have fallen by 10c/kg. The decrease is due to lower resin costs and continued weak demand. BOPA Film prices paid have come down by 10c/kg. The decrease is attributed to lower input costs and continued weak demand. Aluminium foil prices paid are up by 5c/kg due to LME ingot price rising by almost 11 c/kg, and the merchant spot premium was also up. Conversion costs have come down by an average of 10 c/kg. Paper prices paid have decreased by 5c/kg. The reason for decrease is weak demand and material oversupply in the market.”

The polyethylene markets were also weak in the fourth quarter. Kaushik Mitra, Chemical Market Analytics by OPIS, a Dow Jones Company, noted: “Markets were weak in the quarter. Although the quarter began on a positive note, with buying in anticipation of festive buying lifting demand, but the enthusiasm faded quickly, and fundamentals reigned over the market mood. Buyers were cautious as price sentiments were downward, annual contracts drove offtake but some buyers shifted to spot buying as spot/ contract gap was wide. LDPE market tightened in December as a major plant in the UK was down, causing supply disruption and with the plant likely to stay offline for months, the market could be looking at a prolonged tightness as imports are below average. The European Union is likely to allow duty-free imports of US PE grades, which will weigh negatively on local producers who are already cost-disadvantaged. Q1-2026 outlook is flat with some recovery in demand towards the end of the quarter expected.”

Energy costs are trending downwards

Energy costs remain a key factor for converters. European gas and electricity prices in 2026 are generally expected to trend downwards from recent highs, supported by growing renewable generation and policy measures such as Germany’s industrial electricity price cap for eligible firms, although price levels are still expected to remain above pre-crisis averages. At the same time, European flexible packaging demand in Q4 2025 showed signs of stabilisation, supported by cautious consumer spending and value-seeking (including trading down to discounters and private labels) as well as sustained demand for fresh, healthy and convenient products.

Guido Aufdemkamp, Executive Director of Flexible Packaging Europe (FPE), summarised the situation as follows: Q4 2025 was characterised by broad-based price adjustments across flexible packaging substrates and materials. The combination of flat consumption in the end-markets and geopolitical uncertainties only allows a rather stable than optimistic outlook for the flexible packaging sector in 2026. One focus of the suppliers of flexible packaging materials is the further adaptation to the new European packaging legislation, where more relevant details are expected to come out during the year.