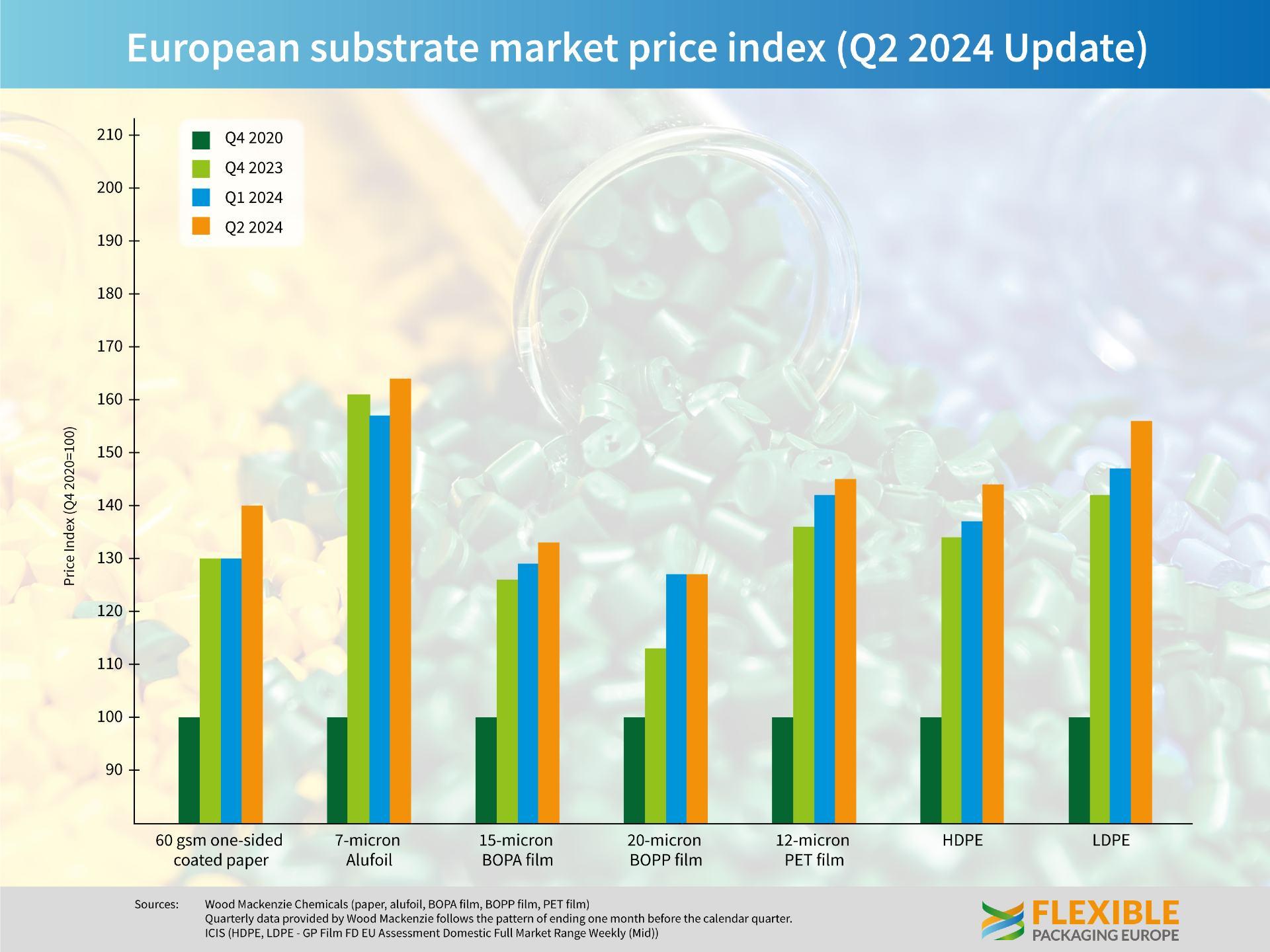

The price of flexible packaging materials across Europe continued the slow increase seen in Q1 as demand continued to rise for most substrates in the three months to end June 2024. Prices were also affected by supply side cost rises for both raw materials and logistics services.

Leading the rises was 60gsm one-sided coated paper, which saw an increase of almost 10% in Q2 compared with the previous 3 months and some 40% higher than the benchmark 100% of Q1 2020. LDPE added 6% but is still 56% higher than Q4 2020 level while HDPE added 5%, climbing to 42% above the benchmark. Seven-micron aluminium foil also climbed 5%, followed by rises of 3% for 15-micron BOPA film and 2% for 12-micron PET film. Only 20-micron BOPP film bucked the upward trend, remaining stable.

Higher raw materials and logistics costs

LDPE, HDPE and 12-micron PET are now back to the levels seen at the start of 2023, while all other materials remain well below the prices seen at that time. However the price of 20 micron BOPP has remained relatively steady during the last 12 months.

Commenting on the figures Santiago Castro from Wood Mackenzie stated, “The prices paid in Europe for flexible packaging materials last quarter were largely driven by supply-side factors, such as higher raw materials and logistics costs. BOPP film prices were unchanged on average due to weaker than expected demand throughout the PP supply chain, which minimised cost pressures. Flexible packaging demand has continued to increase in Q2, with most applications showing signs of improvement. However, demand continues to be described as weak by many.”

Further price increases can be expected

“Further price increases are expected for some substrates, driven again by supply-related factors,” he explained.

Guido Aufdenkamp, Executive Director of FPE added, “The slow recovery in demand is welcome news but price rises driven by increased supply side and transport costs are not beneficial. We anticipate a more sustained recovery is likely as de-stocking has come to an end, but customers remain cautious as end-product demand is also still weak and unpredictable. Geo-political issues such as Gaza and Ukraine have not gone away plus increasing trade conflicts, nor have some of the supply chain issues seen in Q1 and they will continue to put upward pressure on production costs. But overall, there are signs that the situation is stabilising and even slightly improving for suppliers of flexible packaging materials.”