Shipping disruptions in the Red Sea have had a significant impact on supply chains, leading to increased prices of European flexible packaging materials in the first quarter of the year.

Prices across almost every flexible packaging material posted modest price rises in the first quarter of 2024, compared with the end of 2023, due mainly to disruptions in the supply of resin and film caused by the shipping security issues in the Red Sea. Demand remains flat across all material markets.

Steady upward trend

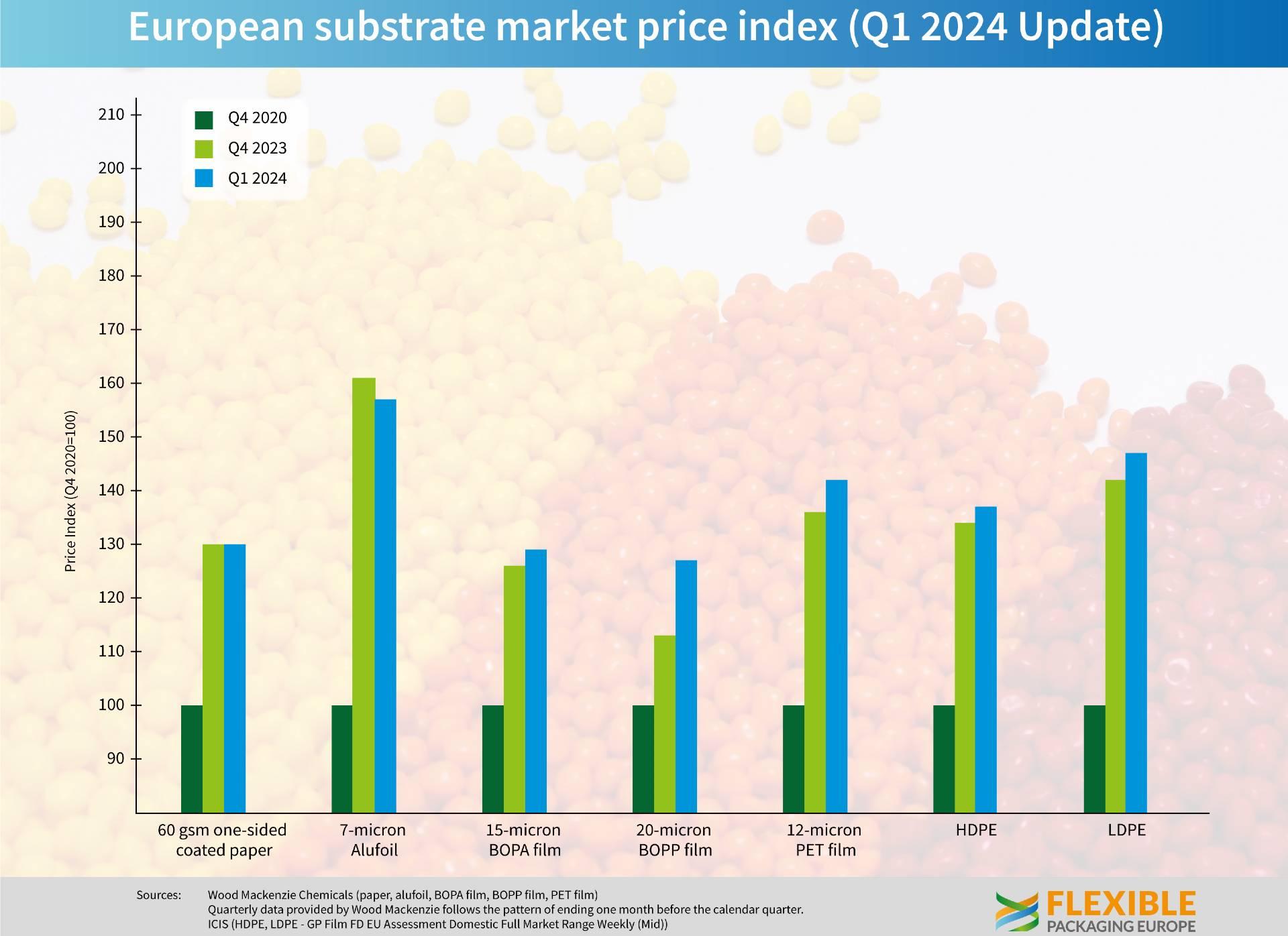

Both HDPE (up 2,3%) and LDPE (up 4,1%) continued the steady upward trend seen in the second half of 2023. 20-micron BOPP film surged 12% and now stands at a price last seen in Q2 of 2023. 15-micron BOPA film added a more cautious 2%, while 12-micron PET gained 4%, pushing it close to its early 2023 price. Only 60gsm one-sided coated paper held steady, with no change compared to the final three months of last year.

Across the board, prices are still well below the levels seen at the start of 2023, with both aluminium foil (down 16%) and 60gsm one-sided coated paper (down 24%) leading the way. However, in comparison with the benchmark of Q1 2020 prices remain between 27% (BOPP) and 57% (aluminium foil) higher.

End-user demand remains weak

Santiago Castro from leading analysts Wood Mackenzie interpreted the latest figures, “Prices paid in Europe for flexible packaging materials mostly increased in Q1 2024. This was the case for BOPET, BOPA, and BOPP, which experienced the most significant increase. Prices paid for paper remained unchanged, but price increases are expected during Q2 due to increases in the cost of pulp. Aluminium foil saw additional price decreases due to conversion cost reductions. Although overall demand has improved for all substrates, mainly this has been due to restocking. End-user demand remains weak, but there are signs of improvement.”

Guido Aufdemkamp, Executive Director of Flexible Packaging Europe, commented on the latest figures: “If anything there is more uncertainty in the market than there was at the end of last year. Escalating tensions in the Middle East generally and the continued threat to shipping in the Red Sea have caused major disruption in the supply chain. The war in Ukraine also continues to have an impact both on supply and wider European demand of packaging materials and packaged goods. These issues are not likely to go away in the near future. But it seems the extreme destocking has come to an end in most segments and restocking to a more normal level has begun slowly. This factor, combined with a cautious upturn in demand, as prices and inflation stabilise, could mean the market for flexible packaging materials in Europe is set for modest growth later this year.”