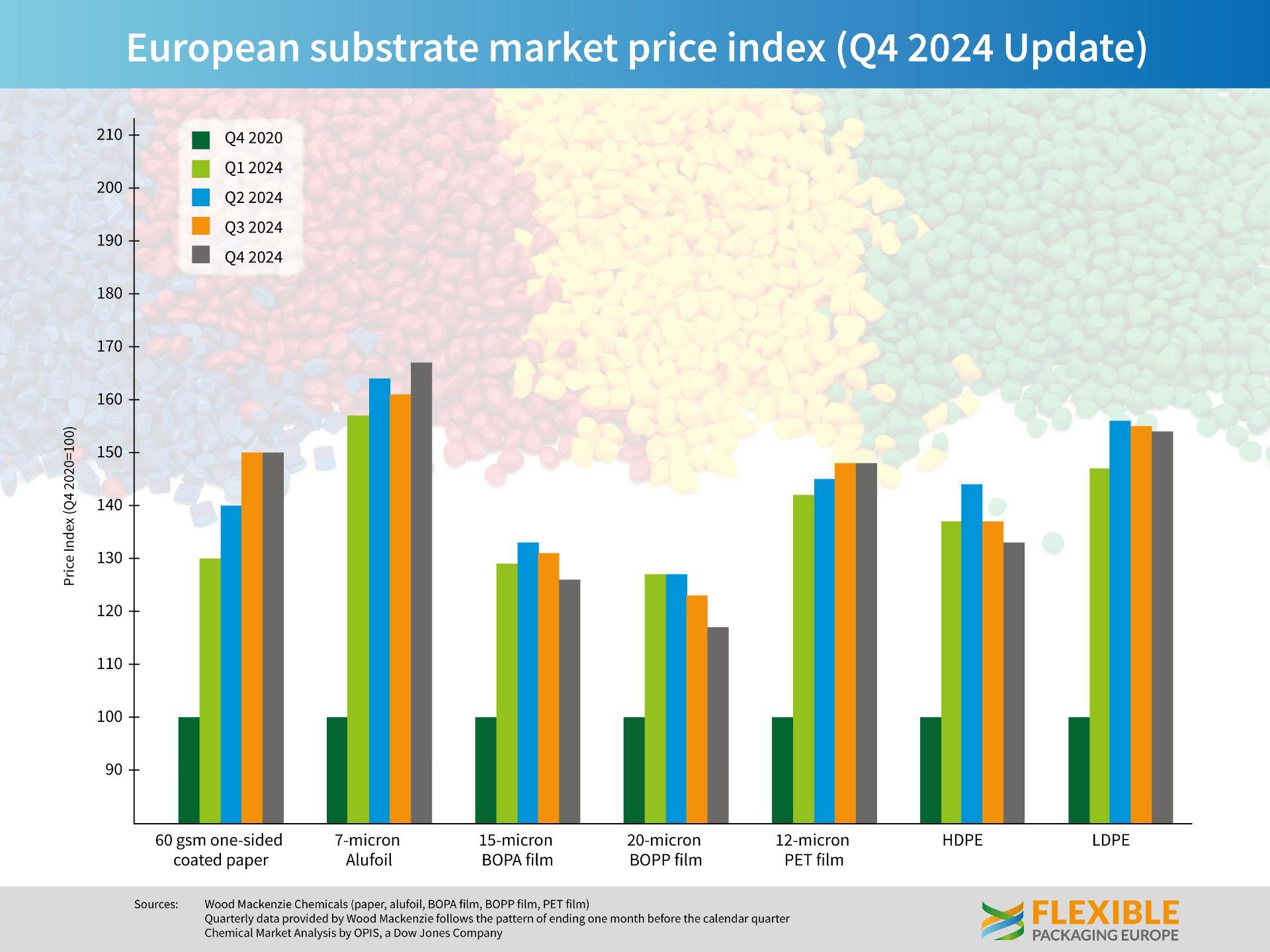

Prices of the basket of flexible packaging materials varied in the final quarter of 2024 as raw material cost fluctuations, supply chain issues and market uncertainty for some materials all had an effect. Figures released recently by Flexible Packaging Europe (FPE) reveal a mixed picture across paper, alufoil and plastics.

Both 60 gsm one-sided coated paper and 12-micron PET film remained unchanged against Q3 2024 figures, while there was a 4% increase in the price of 7-micron aluminium foil driven by strong demand and China cancelling export tax rebates as of 1 Dec 2024. Modest decreases on the preceding quarter were seen for 15-micron BOPA film (4%); 20-micron BOPP film (5%); HDPE (3%); and LDPE (1%).

Price fluctuations in raw materials

Santiago Castro of Wood Mackenzie explained the reasons for these variations, “Prices paid in Europe for flexible packaging materials varied in Q4 2024, driven by price fluctuations in raw materials. BOPA and BOPP suffered price declines, while alufoil experienced price increases. All three were driven by similar price fluctuations in their raw materials. Despite a slight price reduction in short-fibre pulp, paper prices remained relatively stable in the last three months of 2024. Flexibles sales in Europe are still considered to be relatively weak, although they improved compared to the same period in 2023.”

Kaushik Mitra, Executive Director Polyolefin EMEA of Chemical Market Analytics by OPIS, a Dow Jones Company, added: “The market is very challenging and the macroeconomic picture very subdued, which is weighing on demand for plastics. Buyers are cautious and are keeping stocks low and waiting for signals hinting at market improvement. The supply chain is long, despite curtailed production in the region, as imports creep higher. Prices are expected to stay in a range defined by raw material cost and capped by supply chain length.”

Modest price increases

While 2024 ended on a mixed note most prices rose very modestly over the year with only HDPE and 15-micron BOPA film remaining at Q4 2023 levels. Alufoil 7 micron rose 4% while 60 gsm one-sided coated paper added 15% in the same period. PET 12-micron film was 9% above a year earlier and LDPE rose by 19%. Finally, 20-micron BOPP film increased just 3%. All prices remain well above the benchmark of 100% set in Q4 2020 although prices have stabilized considerably.

Commenting on the figures, Guido Aufdenkamp of FPE said, “Market uncertainty remains a key factor, particularly with the new tariff policy by the new US administration and the potential reactions of the European partners in view of the upcoming elections in Germany. Nevertheless, we will have to be patient until confidence in general business and consumption returns. It was encouraging to see modest price rises across most materials but these need to be demand-driven rather than caused by supply problems or raw material costs. 2025 will be challenging but we hope some improvement in the markets will occur as the year progresses.”